In an increasingly digital world, financial markets are changing rapidly. One of the most notable developments in this area is the rapid rise of ETFs (exchange-traded funds). Among the platforms documenting and shaping this space, Fintechzoom.com etf Market has emerged as a key player for investors seeking data, insights, and strategies in the ETF space.

In this comprehensive article, we delve into the world of ETFs as observed and analyzed through the lens of FintechZoom. We examine unique trends, performance metrics, technology integration, and the broader impact of this growing segment. Prepare for a 2,000+ word analysis that not only crunches numbers but also uncovers stories, strategies, and innovations in the ETF universe.

The ETF Phenomenon: Global Growth Meets Digital Accessibility

Exchange-traded funds (ETFs) have experienced exponential growth since their introduction in the early 1990s. By 2025, ETFs will represent more than $12 trillion in assets worldwide, led by the U.S. market. The reason? ETFs offer instant diversification, low expense ratios, and easy tradability.

Beyond the numbers, the way investors interact with these funds is changing. Digital platforms like fintechzoom.com’s ETF Marketplace have revolutionized access to ETFs and offer a transparent, fast, and highly analytical view of the ETF universe. Investors no longer rely solely on outdated brokers or data terminals; they can now access real-time data from around the world.

Why FintechZoom? The ETF Marketplace Authority at fintechzoom.com

Not all financial news platforms are created equal. What sets Fintechzoom.com etf Market apart is its combination of financial technology, analytics, and accessibility. Here are some reasons why FintechZoom has become a key destination for ETF investors:

1. Real-Time Data Analysis

FintechZoom aggregates ETF performance data from multiple markets and provides real-time performance charts, sector breakdowns, and volatility metrics. Investors can make immediate decisions thanks to current, visual, and easy-to-understand information.

2.In-Depth Editorial Content

Unlike traditional media, fintechzoom.com offers in-depth editorial content and ETF analysis. The report focuses not only on price movements but also includes thematic strategies, expert forecasts, and geopolitical impacts.

3.User-Friendly Experience and Customization

FintechZoom’s design allows users to create custom watchlists, set ETF alerts, and track performance against benchmarks, all from a mobile interface. For tech-savvy investors, this represents a significant improvement over traditional dashboards.

Market Trends That Will Shape ETFs in 2025

This year, fintechzoom.com’s ETF Marketplace has focused particularly on the latest trends in the ETF space. Based on user interaction and editorial analysis, these are the most important ETF trends for 2025:

A. AI-Based ETFs

These ETFs focus on companies that develop or utilize artificial intelligence. From NVIDIA and Palantir to smaller biotech companies, these funds are gaining attention due to their exponential growth and forward-looking thesis.

B. Climate and Sustainability ETFs

Green investing is more than just a buzzword. ETFs that prioritize ESG (environmental, social, and governance) criteria are increasingly popular. FintechZoom’s editorial highlighted funds such as the iShares Global Clean Energy and the Invesco Solar ETF.

C. ETFs for Geopolitical Diversification

In the face of rising geopolitical tensions, regional ETFs offer investors a way to hedge global risks. Funds focused on Southeast Asia, Africa, and Latin America are enjoying growing popularity, according to data from the fintechzoom.com ETF marketplace.

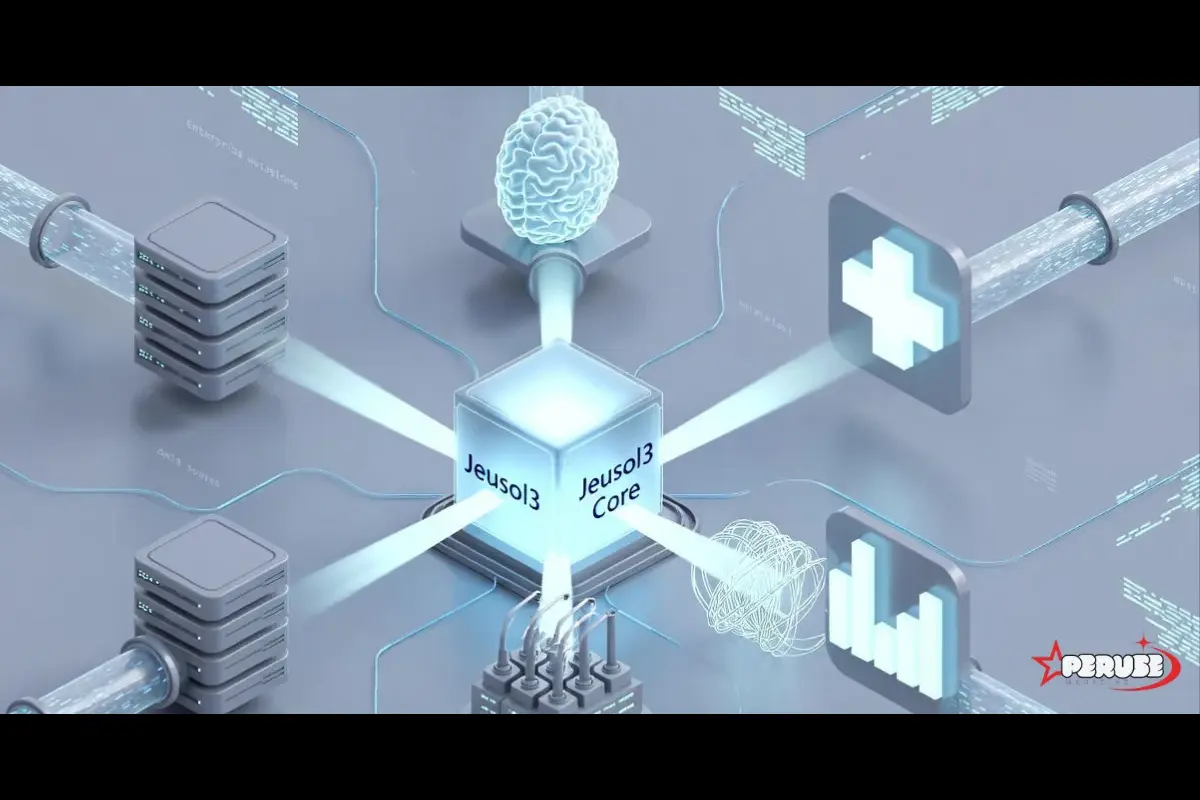

The Role of AI and Data Analytics in Fintechzoom.com etf Market Coverage

One of the lesser-known advantages of fintechzoom.com’s ETF marketplace is the integration of advanced artificial intelligence tools and predictive analytics into the platform.

- Sentiment Analysis: By analyzing social media, earnings presentations, and headlines, FintechZoom’s AI engine determines a “sentiment score” for each ETF.

- Volatility Forecast: Using machine learning, the platform can predict likely volatility for the next 30, 60, and 90 days, providing investors with a clear risk profile.

- Custom ETF Screens: Investors can apply individual filters (such as ESG score, AI exposure, or low CO2 emissions) to uncover hidden ETF gems.

FintechZoom is not just a portal: it’s a suite of tools for the modern investor.

Thematic ETFs: From Climate Technology to Space Research

Thematic investing has found a new home in ETFs, and fintechzoom.com’s ETF marketplace is a leader in tracking these themes. Below are some notable 2025 themes that are causing a stir:

Space Research ETFs

ETFs like ARKX (from ARK Invest) and SPACEX-related funds are widely followed by FintechZoom’s user base. These funds focus on aerospace technology, satellite communications, and orbital infrastructure.

Cybersecurity ETFs

Amid rising digital threats, funds like the First Trust Nasdaq Cybersecurity ETF (CIBR) and the Global X Cybersecurity ETF (BUG) saw record inflows. FintechZoom’s analysis examines the threat landscape and how these funds are responding to it.

Innovative Biotech ETFs

From CRISPR to AI-generated proteins, biotechnology is booming. The fintechzoom.com ETF Marketplace dedicates a section to innovative healthcare ETFs that focus on the medicine of the future.

Risk and Return: Strategic ETF Market Insights by fintechzoom.com

While investing in ETFs may seem safer than investing in individual stocks, risks still exist. FintechZoom’s detailed risk modeling provides tools to help investors find the right balance between risk and return.

1.Portfolio Diversification Score

FintechZoom generates a customized diversification score that shows how much a new ETF increases or decreases a portfolio’s overall risk.

2.Risk-Adjusted Return Calculations

The platform not only displays returns but also compares them to risk and calculates the Sharpe ratio, Sortino ratio, and Treynor ratio for each ETF.

3.Sector Overlap Analysis

Investors often unwittingly double-invest in certain sectors. Fintechzoom.com etf Market visualizes sector overlaps so investors don’t end up with redundant holdings.

Case Studies: Analyzing ETF Performance with FintechZoom Tools

To illustrate the practical benefits of Fintechzoom.com etf Market tracking, we analyze two mini-case studies:

Case Study 1: AI-Powered ETF Portfolio

An investor used FintechZoom’s AI-powered screener to create an ETF portfolio focused on robotics, machine learning, and autonomous vehicles. Over a 12-month period, the portfolio outperformed the S&P 500 by 6.8% thanks to real-time sentiment tracking and risk modeling.

Case Study 2: Sustainable Investment Portfolio

Investor B created a green portfolio that included only ESG-rated ETFs from the Fintechzoom.com etf Market. The result: a 14% return in a volatile year and a decline 22% below the market average—a testament to the power of responsible investing.

Final Thoughts: Democratizing Investing Through FintechZoom

The Fintechzoom.com etf Market has always promised simplicity and accessibility. Platforms like the fintechzoom.com ETF marketplace have further enhanced this promise through technology, insights, and user-centric design.

Whether you’re a seasoned investor or a newcomer entering the ETF market for the first time, FintechZoom enables you to trade smarter, faster, and more securely. FintechZoom doesn’t just inform the ETF market: it shapes it.

In the mid-2020s, we expect to see even more innovations in the ETF marketplace at fintechzoom.com, from blockchain-backed ETFs to funding strategies for quantum computing. The future is open, and ETF-by-ETF is being shaped.

![The rise of Insetprag: how it is transforming the sector/domain The Rise of Insetprag: How It’s Transforming [Industry/Field]](https://apkdatamod.com/wp-content/uploads/2025/12/irewolede-PvwdlXqo85k-unsplash-150x150.jpg)